You might suddenly find yourself in a situation where you need to pay utility bills before the due dates, but your GCash balance is low. Instead of rushing to cash in from your bank, you can use GCredit—a fast, no-approval loan for qualified GCash users—to settle these urgent payments. This guide explains how to use GCredit to handle financial emergencies efficiently.

What is GCredit in GCash?

GCredit is a personal revolving credit line that works like a flexible loan on a credit card. The owner of the GCash account gets a limited amount of money to loan, but the amount cannot exceed the credit limit. You can even avail of several loans simultaneously so long as the total amount does not exceed your credit limit.

The GScore in a GCash account determines the credit limit and if the user qualifies for a loan. The GScore is a trust rating computed based on transactions using GCash, such as buying load, paying through QR code, paying bills, investing, and more. The higher the GScore, the higher the credit limit and eligibility for GCredit.

Getting Started and How to Use GCredit

To start using it, you need to unlock and activate it first:

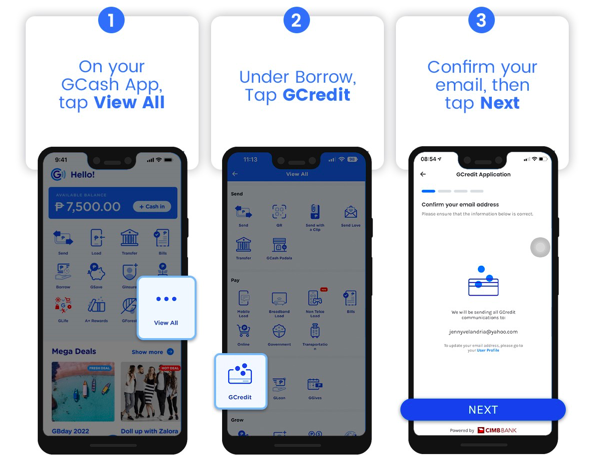

1. Open your GCash app on your mobile phone and log in.

2. On the screen, tap “GCredit.” If you do not qualify for GCredit, a message will appear saying, “You’re Almost There.” If you do allow it, click “Unlock GCredit” to proceed with the activation.

3. Verify if the email address indicated is correct and tap “Next.”

4. Review your personal information and tap “Next.”

5. You must provide additional essential personal information in required fields such as gender, civil status, other mobile or landline numbers (if applicable), and TIN (optional). You must also answer the question if you are a Politically Exposed Person (PEP). Lastly, you need to provide details of the person who can be contacted in an emergency. When finished, tap “Next.”

6. Review the whole application and make sure everything is correct and accurate. Tap on “Submit” to send your application.

Once the application is submitted, a message will confirm your application. You need to wait one to three business days for the approval of your application.

Related: 5 Proven Ways How to Earn Money on Gcash

GCredit Interest Rates

Currently, the GCredit interest rate is set at 5% per month. The interest rate is prorated, assessed, and adjusted according to the number of days the loan is borrowed. The prorated interest rate is still charged even if the loan is paid in full after one day. The formula goes like this:

Principal Amount X 5% Interest Rate X (Number of Days ÷ 30 Days) = Total Interest Amount

To demonstrate: Principal amount borrowed is P500 for 12 days.

P500 X 0.05 X (12 days ÷ 30 days) = P10

Thus, to settle your loan, you must pay P510.

Where Can I Use GCredit?

You can use it to purchase needed essentials, pay for online transactions, and pay bills, just as you can use GCash to pay for any transactions using Pay Bills, Pay Online, Pay QR, and GLife.

Pay Bills

How to pay using credit for your bills; first, find out what partner billers in your area are covered by GCash, then follow these steps:

1. On the GCash app, tap Bills.

2. Select a Category.

3. Select a Biller.

4. Input Account Details and tap Next.

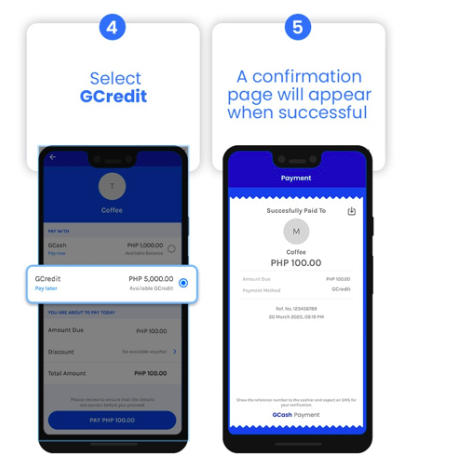

5. Select GCredit and tap Next.

6. A confirmation page will appear if the payment is successful.

Pay Online

Use it for online transactions such as Lazada, Shopee, GMovies, Airline tickets, and many more. Again, check which retail merchants and partners are accepted in your area.

1. Launch the retail/partner app.

2. Upon Checkout, select GCash.

3. Input your GCash account details.

4. Log in to your GCash account.

5. Select GCredit and tap Pay.

Pay QR

Use GCredit to Pay QR with accredited merchants nationwide, such as Waltermart, SM Stores, Mercury Drug, Robinsons, Puregold, and many more.

1. On your GCash, tap QR.

2. Scan the QR code.

3. Input the desired amount.

4. Select GCredit; a confirmation page will appear if the transaction succeeds.

Purchase in GLife

It is accepted by select GLife food and drinks partners like Gong Cha, Bo’s Coffee, Boozy, KFC, McDonald’s, and more.

1. On the GCash app, tap GLife.

2. Select any category.

3. Choose a partner merchant.

4. Tap Checkout.

5. Fill out the details and tap Continue to Payment.

6. Select GCredit, then tap Pay.

7. A confirmation will appear if the payment is successful.

Backup Payment Option for Google Play store or Apple Services

GCredit can be a backup payment option if your balance is insufficient for any purchase.

1. On the GCash app, tap Borrow.

2. Tap GCredit.

3. Tap Online Payment Settings.

4. Tap Enable GCredit as Backup.

5. Tap Enable GCredit.

6. The GCredit is now enabled.

How to Pay Your Loan

A GCredit loan is due 45 days after the loan is approved. GCredit uses a 30-day billing cycle, so the bill is received 30 days after the loan is availed, with an additional 15-day grace period. For instance, if you loaned for GCredit on June 25, you will receive your loan due date bill on July 25. You will then have until August 9 to settle your loan dues.

To pay off your loan, first, make sure that you have enough money in your GCash wallet to pay off the loan. You can add money to your GCash wallet through online banking, remittance centers, or other cash-in options available.

Then, tap “Manage Credit” on the GCash home screen. You will see the total amount due, including interest. Tap “Pay for GCredit.” Enter the amount to pay, which will be deducted from the GCash balance. Although you can spend less than the amount due, paying in full is advisable to avoid additional interest charges. Tap “Next” to proceed. Review if the correct amount is entered, then tap “Confirm.”

If payment is successful, a confirmation text message is sent. Check your GCredit balance by going to “Manage Credit” to ensure the payment has been posted.

A Few Frequently Asked Questions:

Can I transfer GCredit to a bank account?

No. A GCredit loan cannot be transferred to a bank account since it is used for online payments or purchase transactions only.

Can I transfer GCredit to GCash?

No. There is no feature in GCash to transfer any loaned amount in GCredit to a regular GCash wallet account balance.

Can I use GCredit to purchase from Lazada?

No. As of now, Lazada does not accept payments from GCredit. All Lazada purchases can only be paid from the regular GCash wallet balance.

Conclusion

Overall, GCredit is an effective and versatile financial program that can relieve the stress of managing your finances. Plus, given its range of features and security protocols, you can shop online, make bill payments and manage your funds without worrying about fraud or data theft. Why not give it a go and enjoy the convenience of GCredit today? With a few clicks, you can already be on your way to taking control of your money like a total boss!

Recommended: How To Send Money From Paypal To Gcash: Complete Guide 2022