Are you feeling overwhelmed when preparing your business’s annual inventory listing? Don’t worry, you’re not alone. Many business owners share this sentiment. However, it’s crucial to prepare an accurate inventory listing to keep track of your company’s finances and ensure compliance with the Bureau of Internal Revenue (BIR). In this blog post, we’ll outline the updated steps for filing your BIR inventory list and provide tips to simplify the process. Let’s get started!

What is the BIR Inventory List?

The Annual Inventory Listing is a report submitted to the BIR that contains detailed information about a company’s inventory, including supplies and materials, as of the year-end. This requirement ensures that businesses maintain accurate records and declare their inventories in alignment with their financial statements.

The BIR recently updated its guidelines through Revenue Memorandum Circular (RMC) No. 8-2023, which enhances the submission process by mandating electronic submissions. This circular supersedes RMC No. 57-2015 and introduces a more streamlined approach for businesses (source: BIR RMC No. 8-2023).

Who is Required to File the BIR Inventory List?

The following taxpayers are required to file a BIR inventory list:

- Businesses with tangible asset-rich balance sheets, where at least 50% of total assets comprise working capital assets like accounts receivable and inventory

- Businesses engaged in trading or selling goods, including manufacturers, retailers, and wholesalers.

- Real estate dealers and developers.

- Construction companies.

How To Prepare Inventory Listing

This template is for the Retail/Manufacturing, Real estate Industry and, Construction Industry. For discussion purposes, I’ll be focusing on the retail, wholesaler, and manufacturing business. Since most of the companies are engaged in this industry, see the templates here.

What Template Should You Use to Prepare Inventory Listing

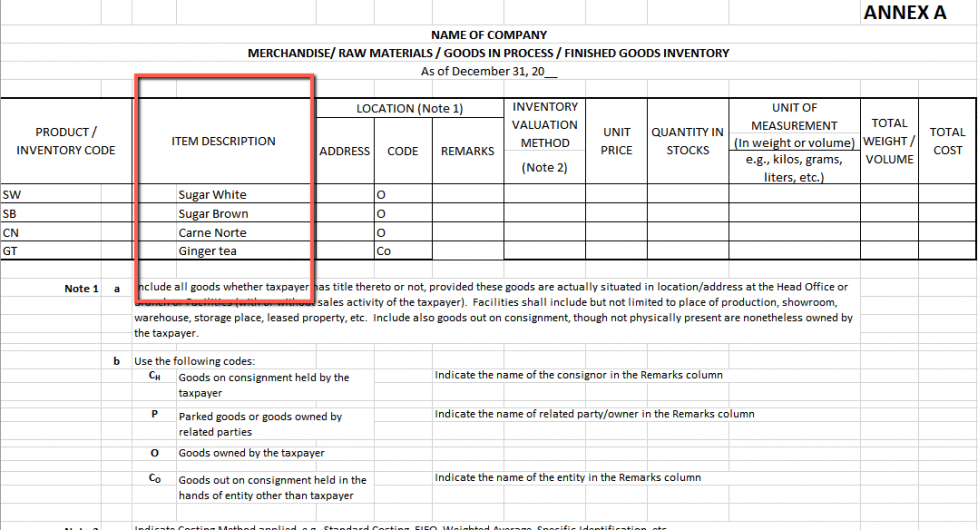

Annex A: Retail/Manufacturing

Use this template if you are engaged in selling items both online or not. This template includes those who are selling dry goods. However, it excludes anyone who is rendering services to the clients. Examples are a salon, barbershop, and even boarding house.

Related: How to Start Sari-sari Store

Annex B: Real Estate Industry

This template is available for engaging in buying and selling natural properties or even real estate developers.

Annex C: Construction Industry

Those who are engaged in construction and contractor agents must use this template.

How To Do Inventory Listing BIR- Step-by-Step

You might not be familiar with many columns or not sure how to fill up that column. To make sure you’re doing it right, I’m going to explain each term and column. Let me use Annex A for retail and manufacturing companies.

Column 1: Product/Inventory Code

In this column, you have to indicate all the unsold stocks you have. Suppose you maintain the coding for each item or product that would be better. However, you can use a short inventory code that could help you to differentiate.

Column 2: Item Description

Make a brief description of your items or products. For example, you can mention the brand name or use it as white or brown for sugar.

Column 3-5: Location

These columns are used if your products or items are on consignment, parked goods, and goods you put on consignment.

In the address, you need to specify the business location, not the personal address. If the private address is the same as the business, then you can use it.

Here are the other Related Tips

- How to Get TIN Number Online and the Verification Philippines 2020

- How to Reduce Your Philippine Tax in 2020

- How to Register Your Business as Barangay Micro Business Enterprise (BMBEs)

- No Payment of Tax on Your Online Business in the Philippines

Besides, four codes are mentioned in the template. Let me tell you what code you should for your goods on hand and goods on consignment.

- CH- are goods or products that are were consigned. To make it simple, let me give you an example. Let us say that you have a friend who requested to sell his products in your business stores. Although you have those items basically, the unsold items are still owned by the consignor or the one who puts his goods on your business.

- P- these are parked goods owned by related parties. These items are not for sale nor consignments. You assume that your friend or family-related business asked you to store their supplies in your business warehouse.

- O- These are your goods. So it means you owned these items.

- CO- If you have other goods or items sent for consignment are still your inventory as long as it is unsold. These items as consignments should have duplicate records in the consignee’s forms. The BIR will investigate any differences in the reported stock. So make sure that your descriptions of items are the same as the consigned goods or commodities.

Column 6: Inventory Valuation Method

In this column, you have to specify what method you use to arrive at your unit cost per item or product. There are many inventory valuation methods, but not all accounting inventory valuation methods are acceptable by the Bureau of Internal Revenue.

For the discussion, I’ll mention only three of those inventory valuations for the annual inventory list. These methods are a weighted average method, FIFO, and Specific Identification.

Total Sold items at the end of the year were 65. What would the unit price on the annual inventory list?

FIFO or First-in-First-Out

This inventory valuation is commonly used today. To make it simple, I’ll give you little data to help you understand how quickly.

The unit price should be 10.15/pc. Why do we use the unit price? Because we assume that all items sold were from the dates starting February up to September 3, 2020. However, we’ve noticed that the total unsold are a portion of the items bought on September 3, 2020.

Weighted Average

This method is the simplest way to compute or determine the unit price of each item or product. To calculate the unit price is to divide the total amounts by the total quantity purchased.

Based on the above data, the unit price is computed as 10.03/pc(792.25/79).

Specific Identification

This method of inventory valuation is usually used by real estate/dealers. This method is generally proper when there is little inventory with a higher unit price.

Column 7: Unit Price

In this column, you will indicate the unit price we computed based on the inventory valuation method you’re using. Unit cost means the price you pay for the goods or items bought, not the selling price.

Column 8: Unit of Measurement

This column indicates how you measure the goods or items. For example, these measurements are kilos, grams, liters, packs, pieces, dozens, etc.

Column 9: Total Weight/Volume

The information you will put here is the unsold items. So, for example, you have to indicate how many kilos are left or still unsold as to sugar.

Column 10: Total Cost

To determine the total cost, you multiply the total weight/volume(column 9) by unit price(column 7).

Related: How to Register Your Business in the BIR

How to fill up the Sworn Statement

This document is necessary when submitting the annual inventory listing to the BIR. Here is the information you need to indicate in the bullets. I’m sure some of the missing data are understandable, but there are some you might be asking.

Let me tell you about the first two bullets.

- The first line you have to indicate if you’re engaged in stock-in-trade, materials, supplies, etc. In this line, if all the inventory list is for sale, you have to indicate stocks-in-trade. However, in some cases, you might use materials to show those inventories are not for sale. For example, the construction industry needs to submit a list listing, but those inventories are not for sale. So it means they have to indicate as materials.

- The following line in the first bullet is you have to indicates what template you used. For example, it could be Annex A or B, etc.

- The second bullet is to mention what RMC number. In this case, it is the RMC 57-2015.

Related: New BIR Form 1709 issued for Related Party Transactions

Key Updates on Filing Procedures

The BIR now mandates the electronic submission of the BIR inventory list to simplify the process and reduce physical document handling. Here are the key updates:

Digital Submission:

- Submit soft copies via Digital Versatile Disk-Recordable (DVD-R) or USB flash drive, properly labeled.

- Include a notarized sworn declaration signed by the authorized representative of the taxpayer.

- Alternatively, you can submit through the Taxpayer Registration-Related Applications (TRRA) Portal available on the BIR website.

Templates:

- Use the templates provided in Annexes A to C of RMC No. 8-2023.

- Annex A for Retail/Manufacturing industries.

- Annex B for the Real Estate industry.

- Annex C for the Construction industry

How To File Annual Inventory Listing

Aside from the annual inventory listing prepared, the following documents must be submitted:

For taxpayers with tangible asset-rich balance sheets with at least half of total assets in working capital assets – hard and soft copies of schedules/lists prescribed herein, using the format provided in Annex A of this Circular for manufacturing/merchandising or retail companies, Annex B and B-1 for real estate companies, and Annex C for those in the construction industry.

Regular Taxpayers – soft copies of inventory list including other applicable schedules stored in a properly labeled DVD-R. This should be submitted with a notarized certification, as provided under Annex D of this Circular, duly signed by the authorized representative of the taxpayer.

If you have any questions, please drop in the comment section. We’re happy to assist you.

Recommended: Top 10 FAQs About Business Taxes

if inventory submission is not indicated in your certificate of registration. Does it mean you may not submit the said requirement annually?

Yes, Even not stated in your COR. As long as you’re in business trade or selling goods then you’re required to submit.

Hello, are suppliers of agricultural products like perishable banana or vegetables have to submit inventories? Thanks

Yes, since you’re selling goods also.

HELlopo, if akopo yun inutuan gumawa at magsubmit ng inventory list ng store ng tita ko, need ko pa po ba ng SPA?para akoyun makapagsign at makapag submit?

Kung ikaw ang inatasan na gumawa at magsumite ng inventory list ng store ng iyong tita, at kailangan mo ring pumirma sa mga dokumento, maaaring kailanganin mo ng Special Power of Attorney (SPA).

Hello… where can I email my inventory? Thanks

You have to file it in the RDO not online filing.

Is there any chance that we can send the Annual Inventory report online, not going to the RDO?

Sorry to tell. But you have to submit the documents to your RDO

If a company is using FY instead of CY, is still required to submit Inventory Listing CY 2021?

Yes, regardless as to the accounting period used.

Hi Good day,

If our unit price is in dollar, how we can report in the inventory list? Do we need to put the the exchange rate instead of the unit price?

Thank you very much.

You can use the conversion rate at the end of the year.

Goid day. Since when does this requirement of BIR started implenting?

Since 2015 po.

Good day, our business only start ng 2020 and due pandemic we missed/didn’t learn yet this inventory listing nor stated in the COR. Need pa rin po ba namin magsubmit for 2020 and hm po ang penalty? or should we just proceed na lng sa 2021. Thank you

Yes. required po. Good thing you didn’t received notice from the BIR.

Sir ako din Po 3 years na Po sa business no transaction ever since due to pandemic ,kaya Po plan ko na isara bIR PERMIT ko ,ngaun ko Lang din po nalamn about sa inventory list ,Wala naman Po dumadating na memo Saken from RDO ,may penalty na Po kaya ako at ano po isubmit ko need ko daw Po Kasi list inventory of goods etc.isa Po sa mga requirements for closure ,,?Sana matulungan nyo Po ako ,salamt

God bless

Sir

Thank you for article.

Can we amend the inventory listing assuming we file it on or before Jan31 this year.

We are having hard time to account our inventories especially our warehouse in VisMin were affected by Typhoon Odette. Thank you

Please, contact your RDO, they might consider it.

Ano po proper label sa dvd-r? Salamat po

Ilagay niye po ang name and TIN of taxpayer, Period covered then signature over printed of owner or any authorized representative.

Good day! Ano po ang tamang label na ilalagay sa dvd-r? Salamat po

Hi Sir. May I know if Salons are still required to submit annual inventory list?

If you’re purely services lang po, no need to submit the inventory listing. However, if there are raw materials, you must submit.

In other RDO’s they don’t required, however yung iba no need to submit. Just to be safe you can ask your RDO.

Hello po ask ko lng po kung aircon services po ang business need pa po ba magsubmit ng inventory list kasi last time po pinasubmit kami eh services lng naman po ung ginagawa namin?ung mga nilagay po namin dun is yung mga gamit namin for doing services tama po ba un?thanks po in advance

No need as long as pure services kayo

when are we going to submit our annual inventory? and do we have to submit it twice or once a year?

The deadline of the inventory listing is January 31st. This inventory listing is only prepared once a year or yearly.

Unit price is the net cost of the unsold item?

Yes, the unit cost of the unsold items.

Hi may I know what should I encode in Annex A: Retail/Manufacturing inventory if we don’t have Ending inventory? Should i leave it blank and submit to BIR?

No need. Just submit only the hard copy for filing purposes. DVD-r is no longer required.

Hi sir thank you for your response. How about the sworn declaration “Annex D” ?

Still need to submit and notarized together with the hard copy of inventory listing.

Annex A and Annex D both need to notarized or just annex D? Do we also still need to edit out the mention of DVD-R on Annex D since we are not going to submit DVD-R?

only the sworn statement to be notarized.Yes..

Hi may I ask if the Authorized Representative can sign the Annex A and D? or it should be the one member of the Board of directors that is authorized to sign the documents?

Anyone who is authorized not necessarily member of the Board of Directors.

Hi Sir. So pwede na po ako yung magsign since ako naman po yung naka authorized na authorized representative na nasa Secretary certificate?

Yes, as long as you have the authorization.

Good evening Sir went

To rdo as we do not have inventory i still filed and peinted 4 copies of annex a and sworn declaration we were advised that no need for the DVDr but they still tequire pa din

Yes, no need for DVDr but you still need the print out of the inventory listing abd sworn statements

I have a pure service business, which I don’t have any inventories. Do I need to submit Inventory List?

No need. Your business is not required on this Memorandum.

What if I’m in the construction industry and providing purely services?

You’re required po.

My mother owns the shop but I am the one tasked to submit this form. My questions are:

– Should the sworn declaration be under my name as the “Authorized Representative” w/my signature and TIN number

– Am I authorized to sign the Inventory (Excel file) itself?

– Is the DVD/R Hardcopy not required anymore

– The sworn statement could be under your name as authorized Representative.

– Yes as an authorized rep.

– DVD/r still required if you have ending inventory.

Is there an eSubmission alternative without the hardcopy for this?

Not this time. You have to submit to the RDO.

I am tasked by my mother to submit this. My questions are:

– Can I submit both signed papers under her name and signature without SPA?

– If not, shall I then put my name and signature on the sworn declaration instead? Will I put my TIN number below or hers?

Last one (sorry)

Can we submit USB instead of DVD-R?

Yes, better option if not expensive.

Thank you Sir Murillo, this is by far the only website that responds. (di ko po inexpect haha)

God bless po sa inyo at sa pamilya nyo.

Welcome! We really appreciate also your positive feedback. We’ll be happy if you will share or subscribe for more tips.

Ang tin number po ba na nasa baba ng authorized representative ay tin number pa rin ng corporation kahit one of the board of members po ang naka sign sa authorized representative?

for the representative po yung ilalagay na TIN

Hi po, ano po yung required na ilagay sa dvd-r? Is it the excel format or the scanned copy? Thanks

excel format.

Hi sir, I’m currently working at a restaurant as accounting assistant.

-Do we need to comply with annual inventory listing?

-If we do, Should we use the format of Annex A.

Thank You.

Yes, because not purely services. and you still be using Annex A.

Hello Sir Rosben!

We don’t have ending inventory for 2021, do we need to edit out the mention of DVD-R on Annex D since we are not going to submit DVD-R and input “No Inventory”, also in Annex A?

Sample:

“That in compliance with Section 13 of Revenue Regulations No. V-1, otherwise known as the Bookkeeping Regulations, submitted herewith is the DVD-R containing the summary list(s) / schedule(s) of inventory supplies and other goods – NO INVENTORY as of taxable year ending 2021.”

No need to submit for DVD-R just submit the hard copy of the inventory listing indicating without ending inventory.

Yung Annex D sir, as is lang? Walang e’dedelete?

You need to fill up the annex D (Sworn statement) and it should be notarized also.

Hello Sir how can i properly state in my sworn affidavit that there is no inventory for the said year.

Just fill up the sworn statement in the in the inventory listing indicate that there is no inventory.

Hi. We own a general merchandise store, non-vat. Do we still need to submit the annual inventory list?

Yes, using Annex A.

what if the nature of business is services? do we need to submit inventory list?what are the forms and necessary docs?

security agency to be exact of the nature of business

No need as long as pure services

Hello. Does a Snack house business include filing annual inventory? ( We make our own burgers, etc.)

Yes, because you have raw materials. Use annex a

Hello , good day sir! ano po ibig sabihin ng ending inventory po ? thank you po and What if wala pong financial statement yung small business ko po pero dti and bir registered, okay lang po ba yun or need ko po gumawa?

Ending Inventory are those items for sale that were unsold. Yes.. even unaudited FS.

Good evening sir! Need po ba bawat page ay may total po sa dulo for Annex A. Thank you so much po.

Either way. Pwedi naman siya. No problem naman yan

Ok po sir, thank you much po sa pagsagot. Sobrang appreciated po, ingat po palagi.

You’re always welcome. Thank you.

Hi Sir, I am employed in a logisitics company just like the jt&e and lbc. I would like to ask if we are required to file an inventory list? We are actually preparing to include the supplies as part of the list but I just want to confirm this. Hoping for a response. Thanks!

Since services no need to submit Inventory listing.

HI SIR im owner po ng furniture maker feb 2019 po ngstart pero until january 2022 no transaction so i decided nalang po n close ko nalng po kasi wala na po tlga ,never po ako ngfile ng inventory ano po kaya dapat ko gawin ,may penalty po ba ako since di ako nkapagfile since 2019 kumpleto naman po ako ng file 1701,2551q,0605,1701A eto po lang wala ako yung inventory ,need ko po kasi magsubmit ng list of ending inventory of goods,supplies including capital goods,,,, sana po matulungan nyo po ako ,,god bless po

Hello, kapag wala pong stock due to pandemic, ano po ang ilalagay sa annex a?

No ending inventory or no inventory.

are restaurants, cafe, milktea shop required submit inventory list? thank you.

Yes, because of raw materials.

does BIR have format in labeling the DVD? May I know the proper way?

None. Just indicate the Name of the company, indicate Inventory Listing and TIN.

Question not related to post.

Can you help me, I’m having troubles understanding the issuance and acceptance of BIR 2307 form.

How do I know if what ATC code should I indicate and what ATC code should our customers indicate in the form.

If the withholding agent is a sole proprietor, and I am a corporation. What ATC Code should he use.

Thanks for replying.

Hi, We have 2 restaurant branch both in pasig. Is the ending inventory consolidated? Thanks

It better not to consolidate. Separate lang po

Also, Are non food inventories/items still included in the inventory? Example packaging materials and other supplies.

Hi sir great day! May i ask po if the inventory list hard copy need to notarized or only the sworn statement?. second question, do i need to scan the sworn statement and save in dvdr or no need?. third, do i need to sign the inventory hard copy and scan, or it shouild be in excel format?.. thank you. hoping to here from you. Godbless

First, Only the sworn statement to be notarized. Second, No print three copies. Third, In excel format with signature and indicate the TIN.

thank you so much sir for the response, but regarding my third question po did you mean print the inventory list in excel form then i will sign it then need to scan ?. or just a e-signature?. thank you po

just for clarification po sir im asking poo regarding the one i saved in the dvd-r do i have to print my inventory list first in excel format then sign and scan then save?. or just an e-signature only?..or no need to sign soft copy?.

Save the excel format, then print 3 copies and sign.

What if nag closed shop/stop operation 2020 due to pandemic at zero inventory, pero registered pa din sa BIR until now. Need pa din mag submit ng hard copy of inventory list with sworn declaration? How much penalty if hindi nkapag submit ng 2020 list.

Yes, just submit the hard copy of the inventory listing indicating with no inventory.

How much po penalty for non submission of 2020 invty list?

failure to supply information without tax due is ranges from 1,000-25,000 depending on the gross sales or receipts.

Good day! Sir Rosben need your help! Saang RDO po dapat i-file ung inventory sa Head office po ba or dito po sa Planta (Warehouse) . Thanks po

Saan po nakaregister Yung main office mo? Don ka po manfile ng inventory listing

Yes, sa main office mo where your business is registered.

Hello sir,need your help!

It’s my first time to do this annual inventory list, how will I do it if I don’t have ending inventory what colum will I wrote or use po.

Just indicate lang no inventory in the Annex template

Hello sir, please help po, I was shock to received a first notice from BIR stated that year 2018,2019 and 2020 no annual inventory list I submitted. But honestly I didn’t know about this and how to do it. I do inventory but for my records only. My question is do I start making my inventory for the year 2018? And how to do it po if no ending inventory.

I suggest po na magpaassist kayo sa RDO niyo. But at this time, just submit the Inventory listing for the year 2021 only.

How about school?Do they need to pass Inventory List?

Nope.

Pag school po ang business may inventory list din po ba?

If you do not have inventory, being a Company engaged in providing service, do you still need to submit the Annex and indicate “No Inventories”? Or not required anymore?

No need as long as pure services

Thank you for your immediate response.

You’re always welcome.

May sample computation po kayo ng annex C?

Sorry, I don’t have.

May prescribed na file name po ba yung excel file na ilalagay sa DVD-R? Thank you!

No prescribed as long as you indicated as for Inventory listing and then company name with tin.

I have question regarding this statement Po: Make sure the cost of ending inventory to be indicated in the inventory listing must equal or the same amount of ending inventory presented in your financial statements.

– lahat ba ng business ay need magsubmit ng financial statements sa BIR?

Not at all. Please check those who are required to submit inventory listing.

One more question, please. Allowed ba ang sari sari store mag cash basis? If yes, magsa submit pa rin ba ng hardcopy and softcopy ng inventory listing?

Yes, actually most of the sari-sari store are in cash basis.

Yes, hindi po siya nagmatter kung cash basis o hindi sa pagsubmit ng Inventory listing

Ang business po na engaged sa pagbebenta ng gasul, pwede rin pong mag cash basis? Kapag cash basis po diba zero ang ending inventory dahil yung total purchases ay declared as COGS. Please correct me if I’m wrong. Thank you!

No. If you want to know more. ill be happy to assist you personally.

I’m happy to seek help from you sir. Please contact me at macabontoceden@gmail.com

Hope to hear from you soon

Good day sir, unang tanong ko po pag small sarisari store lang po ang business kailangan padin po ba mag submit nang inventory list?

Second question ko po if apartment po ang business kailangan padin po ba mag submit nang inventory list?

Yes, as long as registered with the BIR

If you’re selling apartments, then Yes, however, if not for services only then no need to submit inventory listing.

Hi Sir. Just a few questions below:

1. Annex A lang po ang required na iprint and isave sa DVD-R? No need na po yung inventory valuation?

2. Kung sa HO po magfile, then we have 2 other branches with the same item, per line ko po ba ilalagay yung item code & Description to reflect the address?

3. If yes po yung no. 2, can I use the remarks to tag the Branch and HO?

Thank you po.

1. Yes

2. Yes also

Hi.

We are a corporation and applied for registration under “Refreshment stands, Kiosks and counters” as Line of Business with the BIR.

Since incorporation and BIR registration, we have not started any business due to pandemic and quarantine. Now, we are planning to officially close our business registration with the BIR and dissolve our corporation since we can’t see our company opening soon in 2 years.

I would like to ask if we still need to submit the List of Ending Inventory and notarized Sworn Statement with regard to our circumstance.

Thank you very much and more power to your blog!

Yes, as long as Hindi pa naprocess yung closure sa BIR.

hello. will they return the usb once done submitting?

Nope. So better to buy a cheaper one.

canyou attachthefromhere?

You may download the form. from this article

Hello sir for Annex C po kaka operate pa lang po ng construction firm wala pa po kami project ano po ilalagay ko? Thanks po!

No inventory or materials.

Hi Sir,

Kailangan po ba namin magsubmit ng inventory list kung wala nmn inventory list sa FS namin pero may WIP po kami? Lagi po kasi nakalagay na the list should be reconciled with the amount declared in FS and ITR.

Thanks po, your blog is such a great help.

Yes, sa WIP po Yung focus niyo. Sa FS regarding sa WIP must be the same

Question po, need po ba na magpapasa sa RDO is sya rin yung nakalagay na authorized representative sa Sworn Statement? Pwede ba na authorized representative yung accountant ng company?

Yes, as long as authorized.

Thank you! another one po. What if yung owner yung nag-sign, then accountant magpasa sa BIR. Do we need authorization letter?

No need. As long as it’s completed and for submission only.

Sa unit price po ba vat-ex. or vat-inc. ang ilalagay? TIA

Hi, good day!

clarification lang po sana Sir. ung employer ko po, may 2 different line of business (diff. business name also). ung isa w/ last TIN 000, construction po (service and mfg of hollow blocks) and ung 001 ay manufacturing ng tanks. my questions are: 1) separate po ba ang Annex A inventory list ng 000 (mfg of hollow blocks) and 001? 2) wala pong on-going project at the end of year 2021, magsa-submit pa rin ako ng Annex C na may sulat na No Ending Inventory, tama po ba? 3) using the format provided sa blog nyo po, do i need to edit ung heading if raw materials lng meron?

thank you po

Yes, separate po yung pagsubmit ng inventory listing.

thank you for the response sir. much appreciated po. God Bless and more power!

separate din po ba Annex D nila and paano po ung CD-R?

Hi Sir,

Do we need to put an e-signature sa Excel file?

What are the requirements if we need to amend the previously filed inventory report?

Just file another inventory listing to replace it.

HI SIR im owner po ng furniture maker feb 2019 po ngstart pero until january 2022 no transaction so i decided nalang po n close ko nalng po kasi wala na po tlga ,never po ako ngfile ng inventory ano po kaya dapat ko gawin ,may penalty po ba ako since di ako nkapagfile since 2019 kumpleto naman po ako ng file 1701,2551q,0605,1701A eto po lang wala ako yung inventory ,need ko po kasi magsubmit ng list of ending inventory of goods,supplies including capital goods,,,, sana po matulungan nyo po ako ,,god bless po

Hi sir good day

Sir 3 years na Po Yung furniture shop ko line of business is (5239 other retail sale in specialized store )no transaction Po kme since nagbukas Po Ang business ko ,dahil Po sa pandemic ,nakakapagfile Po Ako Ng 1701Q,2551Q_2018,1701A,at 0605 every year,

*need ko rin po magfile Ng Inventory list every year (no transaction Naman Po kme palgi)?

*Balak ko na po Kasi isara BIR permit ko sir,eh Isa Po pla sa requirements Yung list of ending inventory of goods, supplies,including capital good ,ano po kaya dapat ko gawin 😞

At sir Yung mga kahoy po na Sana panimula ko eh sa sobrng Mahal Po Ng gasul pinanggatong nalang po namen😞sana Po sir msagot nyo po katanungan ko 🙏🙏🙏

God bless po

Hello po ask ko lang po kailangan po ba talaga na mag submit ng inventory list for the year 2016, 2017,2018,2019,2020 and 2021? Now lang din po kasi namin nalaman na meron palang ganyan.. We recieve a mail from the bir dun palang namin na laman and yung business po is non existing na since 2018

hi, my business is purely services. you said that we are not required to file, is this the same case even i have inventory listing on my COR po?

or do i need to do something even im not required?

You have to make some changes with your COR, becuase if you’re pure service business no need to require to submit the inventory listing

Hi Sir! Nagtatahi po ng bag ang aking negosyo.

Ang inventory po b n gagawin ko ay yung raw materials o yung bag n nayari n po n hindi p nabenta?

TIA

Yes, yung mga raw materials po na gamit kasi considered kayo as manufacturing yung nature niyo.

Hi sir. Paano po if may nailagay na amount sa merchandise inventory pero hindi naman for sale talaga yung balance nun, required po bang magsubmit? Pure service po ang business. Thank you.

Punta po kayo sa RDO niyo then ipacorrect niyo po.

Hello Sir/Mam how about Eatery or mga kainan na take out lang po do they need to submit Annual Inventory List thanks po. And What about school Supplies who only register last August 2022 but did not whatsoever open there business because they are inside the school premises and not yet allowed to open this year. Need pa din po band magsubmit nito with no operation and zero inventory supplies? Thank you for the answer.

Yes, required then magsubmit.

Hello po, we are operating as a manufacturing company, may I know if we are required to report spareparts inventory aside from the trade inventories that we have (RMPM,WIP, FG)?

Yes, required parin. As long as they’re not considered as office supplies

Good day po sir. Clarification po kung sa Unit Price po ba gross or net of VAT? Thanks

It should be the cost not the selling price.

Good day po,

As per our RDO, BIR uploaded the “New Invetory List” Format on their official website in the Downloadables Section but when I checked it, I can’t find it & Cooperative po kami ang Business Category namin means we are Tax exempted but required to filed Withholding Taxes & Inventory List burned in DVD-R with Supporting Documents. Can you assist us to find the “New Invetory List” Format they mentioned lately to me? TIA po.

Sorry, I haven’t seen the update yet as far Iam concern. You can directly ask your RDO.

Dear Sir,

Sarisari store po kami and we started last March 2022, paano po kung hindi namin nakuha yung inventory as of Dec. 31, what is the best thing to do po to comply with the inventory report?

Thank you,

Nedy

Magfile po kayo sa inventory listing then pay the fines for the late submission. Magfile parin kayo.

Sir, may penalty na po kapag as of today ang inventory na isa submit? tama po ba? late ang inventory pero hindi late ang submission, pay pa rin po ng fines? for clarification lang po. Salamat 🙂

Yes, may fine parin siya. Late submission of inventory listing so entitle parin sa fines.

Sir, Nagbigay na po ako ng Final Inventory sa Accounting dept. po namin tapos bumalik po sa akin at dinagdagan po nila. Tinanong ko po bakit lumaki from 13M naging 50M ung inventory, sabi nila ginawan na daw po nila ng resibo at Ok na daw po, Since umupo po ako last 2019 as Inventory Head ng department ko. Hindi naman umaabot sa ganun kalaki ang Inventory List ng company, from 13M to 20M lang po umaabot, Ok lang po ba dinagdagan po nila sa accounting department po namin?

Hello Good Afternoon may I ask if GUESTHOUSE business needs to submit Sales Inventory po ba? And if need where can I download the file? Thank you

Is your main business is providing services? If yes, then you’re not required to submit the inventory listing.

Hi Sir, even if No inventory po ba ay may penalty pa rin if not submitted on time?

Yes, even no inventory still require parin to submit indicating with no inventory. The reason for submitting is to inform the BIR that you dont have the inventory. If no submission, it presumes you have inventory.

hi sir,

we are currently doing business of a surplus cars, we have big volumes of cars, do i need to submit it one by one, let say for example we have a total of more or less 400 units in any variants, bongo trucks, wing van, mini van (transformer), mini dump truck, dump trucks, multicab dropside

and we have no fix price, how can i determine the exact price to put in the inventory?

thanks.

Yes, you can use the cost of sale not the selling price.

Hi sir from real estate po. Di kopo maintindihan kung bakit may beg AR sa installment sales ng annex B1. Diba po installment sales is less than 25? Based lang namn s collection yung recognition mg sales

Good day p sir. Consolidated po ba ang inventory list? Or separate ang inventory list ng main at branch? If separate po, saang RDO ang submission? Sa RDO po ba ng main o sa RDO ng branch. Looking forward your response. Thank you very much and God’s best.

You have to submit separate inventory listing.

for business on forestry.and timber, is inventory filing still required?

Hello! May I ask about the unit price indicated on the inventory, is it the original price the item was bought before resale or the resale price already? Please help. Thank you very much!

It’s the purchased price plus the transportation expense from the supplier.

hi, any idea kung paano mag fill up ng Inventory List pag Real Estate and no sale walang benta po? may sample po ba kayo thank you so much sa sagot!

File po kayo with no inventory.

Hi Sir, can I ask what is the proper naming convention of Annual Inventory List template in the USB. Thanks